VP - Home Mortgage - Capital Markets Portfolio Strategy

Corporate and Administrative

Plano, Texas; Glen Allen, Virginia; Irving, Texas

Description

The VP - Home Mortgage - Capital Markets Portfolio Strategy leads the development of cross-functional analytics, modeling, and management reporting to inform strategic recommendations on margin management, MSR valuation, recapture and lead generation, CRA performance, and related areas. This role integrates data analytics, business strategy, and compliance, transforming complex and diverse data sources into actionable intelligence that drives successful outcomes across multiple initiatives.

The ideal candidate will possess deep expertise in residential mortgage origination and analytics and demonstrate the ability to collaborate effectively with mortgage and consumer banking teams to exchange information and promote accountability.

This position requires frequent engagement with senior leadership, including regular presentations of findings and strategic recommendations. Exceptional presentation and communication skills are essential for success in this role.

Primary Responsibilities Include:

CRA Data Integration, Analysis, and Reporting: Develop and maintain CRA tracking systems that consolidate data from diverse sources. Build models to monitor lending performance and automate data validation for accuracy. Create Tableau dashboards to visualize CRA metrics and produce reports that highlight key trends, risks, and opportunities (20%)

Ex-Ante Customer Behavior Analysis: Develop analytics and models to enhance pricing margin management and mortgage asset valuation at the customer level. Focus areas include borrower behavior in the MSR portfolio (particularly refinance responsiveness impacting perceived lead quality and price elasticity) and correspondent seller performance, including delivery profiles and MSR performance. (20%)

MSR Prepayment & Default Projections: Assess Citizens’ MSR and whole loan assets, both existing balance sheet and new production, to identify cohorts with elevated runoff or default risk under specific economic scenarios. Recommend potential liquidation and/or future acquisition strategies based on risk insights. (20%)

Executive Dashboard Creation: Design and maintain executive dashboards in Tableau to support performance tracking and strategic decision-making. Ensure dashboards deliver clear insights at a high level, with options for granular data exploration and deeper analysis aligned with organizational priorities. (20%)

Ad Hoc Analytics: Rapidly develop analytics to support real-time decision-making and ad hoc initiatives. Continuously manage and adapt insights to reflect evolving discussions and changing environments. (20%)

Management Responsibility:

The VP of Portfolio Strategy is a strategic individual contributor supporting Citizens Home Mortgage Capital Markets, including pricing, hedging, loan sales and delivery, acquisitions, and MSR valuation. While not a people manager, this role is expected to provide strong thought leadership across these functions.

Skills / Competencies:

Technical Proficiency Requirements:

- Advanced Data Analytics: Expertise in Microsoft SQL for complex data extraction, transformation, and analysis across multiple data sources

- Visualization Expertise: Tableau (or other reporting tool) development skills including calculated fields, parameters, LOD expressions, and dashboard optimization

- Statistical Analysis: Understanding of automation and/or predictive analytics using tools such as Python or PowerShell

- Database Management: Experience with data warehouse concepts, ETL processes, and working with large datasets / databases

- Microsoft Office Mastery: Expert Excel skills including complex formulas, pivot tables, macros, VBA, and financial modeling; Advanced PowerPoint capabilities for executive presentations

Industry Knowledge:

- Knowledge of HMDA data requirements, geocoding methodologies, and fair lending principles

- Deep understanding of drivers impacting mortgage asset performance

- Deep understanding of drivers impacting mortgage borrower/customer behavior.

- Mortgage lending lifecycle from origination through sale

Business and Strategic Competencies:

- Strategic thinking capabilities to identify market opportunities and develop innovative CRA solutions

- Project management skills to lead complex, cross-functional initiatives

- Change management expertise to drive adoption of new processes and technologies

Communication and Interpersonal Skills:

- Exceptional written and verbal communication skills with ability to distill complex regulatory and analytical concepts for diverse audiences

- Executive presence and confidence to present to senior leadership and board members

- Strong interpersonal skills to build relationships across organizational boundaries

Experience:

Minimum Required:

- Minimum 10 years of progressive experience in banking, mortgage lending, or financial services with direct exposure to data analytics

- Demonstrated expertise in data analysis and reporting with proven ability to work with large, complex datasets from multiple sources

- Hands-on experience with mortgage lending data including loan-level origination data, servicing data, and secondary market execution metrics

- Track record of developing executive-level reports and presentations that drive strategic decision-making

- Experience supporting regulatory examinations or audits with data analysis and documentation

- Proven ability to manage multiple complex projects simultaneously while meeting strict regulatory deadlines

Preferred:

- Previous experience working with and / or tracking data related to CRA requirements or similar regulatory compliance role within a depository institution

- Prior involvement in capital markets operations and secondary mortgage markets.

- Prior quantitative work with mortgage servicing rights and recapture analysis.

- Track record of implementing process improvements or system enhancements that improved analytical capabilities

Education:

- Bachelor’s Degree in Finance / Economics / Communications / Business Analytics / STEM

Hours & Work Schedule

- Hours per Week: 40

- Work Schedule: M-F

Role is based out of Citizens' office 4 days/week.

#LI-Citizens6

Some job boards have started using jobseeker-reported data to estimate salary ranges for roles. If you apply and qualify for this role, a recruiter will discuss accurate pay guidance.

Equal Employment Opportunity

Citizens, its parent, subsidiaries, and related companies (Citizens) provide equal employment and advancement opportunities to all colleagues and applicants for employment without regard to age, ancestry, color, citizenship, physical or mental disability, perceived disability or history or record of a disability, ethnicity, gender, gender identity or expression, genetic information, genetic characteristic, marital or domestic partner status, victim of domestic violence, family status/parenthood, medical condition, military or veteran status, national origin, pregnancy/childbirth/lactation, colleague’s or a dependent’s reproductive health decision making, race, religion, sex, sexual orientation, or any other category protected by federal, state and/or local laws. At Citizens, we are committed to fostering an inclusive culture that enables all colleagues to bring their best selves to work every day and everyone is expected to be treated with respect and professionalism. Employment decisions are based solely on merit, qualifications, performance and capability.

Background Check

Any offer of employment is conditioned upon the candidate successfully passing a background check, which may include initial credit, motor vehicle record, public record, prior employment verification, and criminal background checks. Results of the background check are individually reviewed based upon legal requirements imposed by our regulators and with consideration of the nature and gravity of the background history and the job offered. Any offer of employment will include further information.

Benefits

We offer competitive pay, comprehensive medical, dental and vision coverage, retirement benefits, maternity/paternity leave, flexible work arrangements, education reimbursement, wellness programs and more.

View Benefits

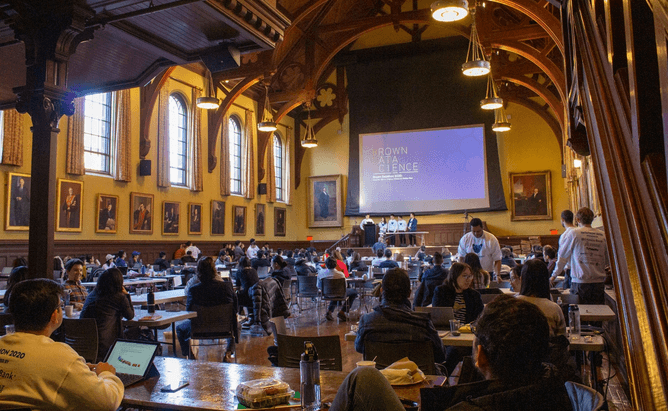

Awards We've Received

Glassdoor Best Place to Work in Consulting, Finance & Insurance

The Banker's

US Bank of the Year

Dave Thomas Foundation’s Best Adoption-Friendly Workplace

Disability:IN Best Places to Work for Disability Inclusion

Human Rights Campaign Corporate Equality Index 100 Award

- Property Project Manager Johnston, Rhode Island Johnston, Rhode Island

- Sr Field Marketing Manager For Private Bank West San Francisco, California; Los Angeles, California; Menlo Park, California; San Diego, California San Francisco, California, Los Angeles, California, Menlo Park, California, San Diego, California

- Custodian Tech - Floater Worcester, Massachusetts; Sturbridge, Massachusetts; Marlborough, Massachusetts Worcester, Massachusetts, Sturbridge, Massachusetts, Marlborough, Massachusetts